Imagine strolling into your dental appointment feeling confident, assured that your insurance details are sorted and you'll face no surprise costs. This peace of mind springs from a robust dental insurance pre-verification process, an essential step often skipped in dental practices. As healthcare gets more complex, grasping the nuances of insurance pre-verification becomes vital for both dental teams and their patients.

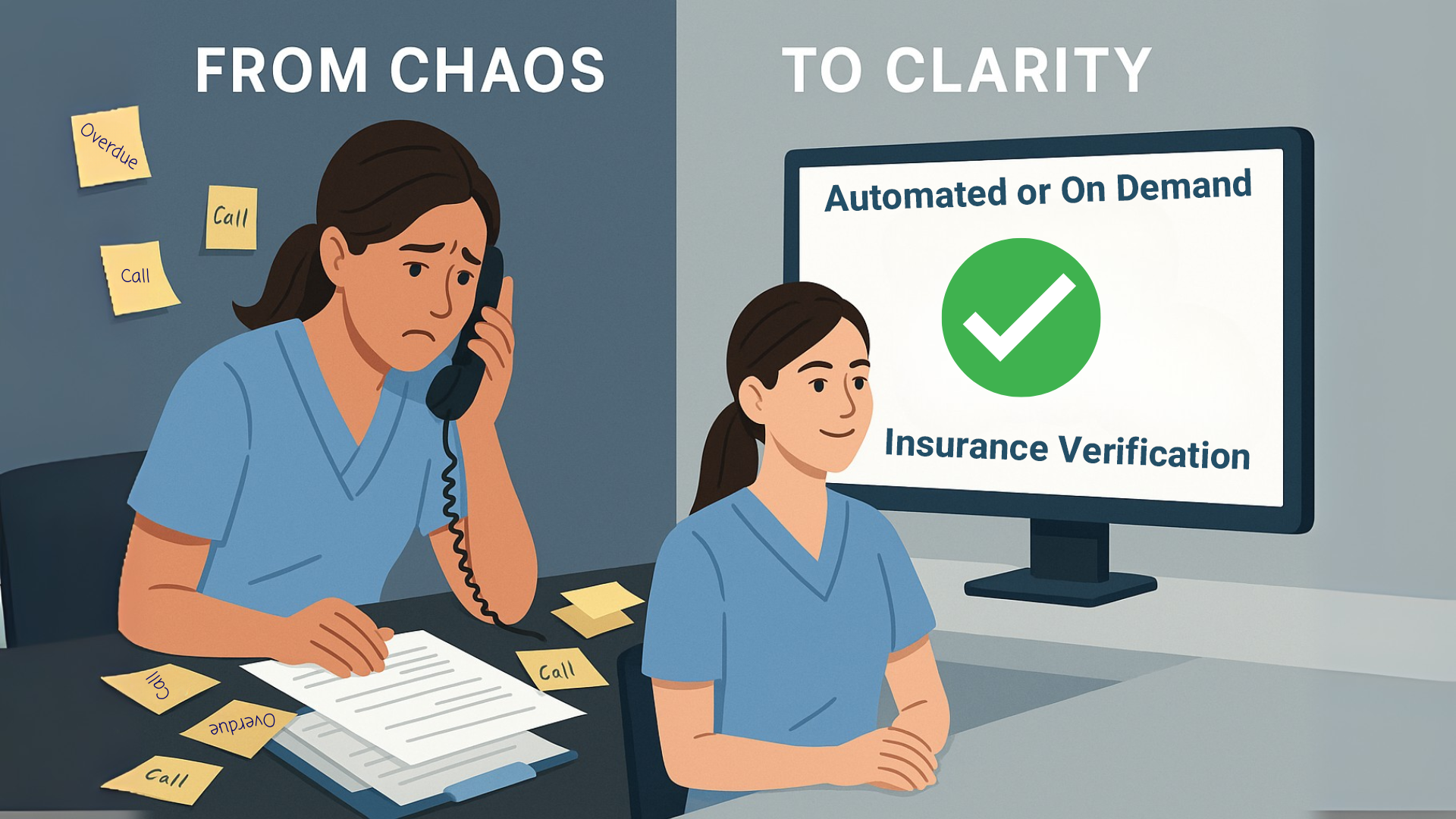

Dental insurance pre-verification plays a key role in ensuring smooth communication among insurance providers, dental offices, and patients, significantly boosting the overall experience. By truly understanding pre-verification, dental practices can dodge billing errors, reduce claim rejections, and enhance patient happiness. Plus, automated insurance verification has changed the game, providing a streamlined approach that saves time and cuts down errors, leading to smoother practice operations.

This guide dives into how technology is transforming insurance verification, strategies to optimize practice systems, and tips to tackle common challenges. From navigating the tricky insurance landscape to implementing custom solutions that fit the unique needs of practices and patients, this article arms dental professionals with the insights and tools they need to master insurance pre-verification.

Understanding Dental Insurance Pre-Verification

Dental insurance pre-verification is a pivotal step that sets the stage for successful billing and claims processing in dental practices. This process involves checking a patient's insurance coverage details before services are provided. By doing so, practices can ensure that the insurance information on file is accurate, helping to prevent claim rejections and administrative delays. Accurate pre-verification not only supports the financial health of dental practices but also enhances patient experience by clarifying what costs the patient should anticipate. Utilizing practice management software and real-time verification tools can vastly improve the efficiency of this process, minimizing potential errors. As a foundational element, pre-verification ensures that both the dental teams and patients are informed well in advance, leading to a more transparent interaction regarding the patient's insurance benefits and coverage details.

Importance of Pre-Verification for Practices

Pre-verification of dental insurance is essential for ensuring that dental practices maintain a smooth, efficient workflow while securing a steady revenue stream. This process is vital in preventing claim denials, which can disrupt a practice's cash flow and delay payments. Streamlined pre-verification processes are key to saving valuable staff time, allowing them to focus more on providing excellent patient care rather than being bogged down by administrative tasks. By implementing technologies such as automated software and real-time verification tools, practices can significantly reduce the chance of errors and administrative delays that often occur during manual verification. These tools provide immediate access to a patient's insurance coverage information, facilitating informed decision-making without the added wait for confirmation. In effect, an efficient pre-verification system helps lay the groundwork for a more effective billing process, directly influencing how quickly practices receive compensation from both patients and their insurance providers.

Benefits for Patient Experience

Automating insurance verification processes within dental practices significantly bolsters the patient experience by reducing the manual workload on staff and diminishing the likelihood of human error. Confirming insurance eligibility in advance enables practices to communicate potential plan limitations to patients beforehand, thus preventing billing surprises and ensuring a transparent financial interaction. Automated software helps minimize wait times for insurance eligibility confirmations, consequently enhancing patient satisfaction and improving the overall workflow of the practice. Timely and accurate insurance verification not only prevents claim denials but also mitigates payment delays, creating a seamless billing experience for patients. By outsourcing these verification tasks to specialized experts, practices can better focus on direct patient care, ensuring that administrative tasks do not detract from the quality of care provided. This shift not only optimizes practice efficiency but also elevates the overall patient experience.

The Role of Automation in Insurance Verification

Automation is transforming the landscape of dental practice operations, particularly in the realm of insurance verification. By leveraging technology, dental offices can streamline the traditionally burdensome and error-prone process of verifying patients' insurance coverage. Automated systems allow practice teams to efficiently access real-time information about patients' insurance plans, eligibility, and benefits, which not only boosts operational efficiency but also ensures accuracy. The automation of these administrative tasks reduces the workload on staff, minimizes the risk of human error, and accelerates verification times. This shift towards automation facilitates smoother billing processes, reduces the incidence of claim denials and billing discrepancies, and ultimately contributes to improved cash flow and financial health for dental practices.

Why Automate Verification Processes?

Automating insurance verification processes plays a critical role in alleviating the administrative burdens faced by dental practices. By eliminating the need for extensive manual data entry and laborious phone calls to insurance providers, staff can redirect their focus towards enhancing patient care. Automated systems significantly streamline the workflow by offering real-time access to insurance coverage details, resulting in improved patient satisfaction and faster service. Additionally, reducing the prevalence of claim denials and ensuring accurate billing strengthens the revenue cycle efficiency. By integrating these automated solutions with practice management software, dental offices can achieve more seamless synchronization of patient information with insurance databases. This not only saves valuable time but also contributes to creating a more focused and efficient practice environment, ultimately allowing dental teams to concentrate on delivering quality patient experiences.

Tools for Automating Verification

The implementation of specific tools designed to automate the insurance verification process is a strategic move for dental practices striving for efficiency. By reducing manual intervention, these tools effectively cut down on errors, ensuring that insurance verifications are both swift and precise. In the dental sector, dedicated verification software is available to conduct real-time checks against insurance databases, confirming patient eligibility. This advance means dental staff can easily access crucial information without time-consuming manual efforts.

Integrating verification software with electronic claims management systems can vastly streamline not only the verification process but also broader financial tasks within a dental practice. These comprehensive systems allow practices to handle both verifications and billing seamlessly, reducing the likelihood of claim rejections. The availability of real-time information means that dental practices can offer patients immediate, updated insights into their insurance coverage and benefits, ensuring transparency and enhancing the overall patient experience.

Such real-time verification tools are indispensable for dental offices aiming to maintain precise and efficient operations. By providing immediate access to accurate insurance information, these systems are pivotal in reducing billing surprises for patients and administrative workload for staff. Automation empowers dental teams to allocate more resources and attention to patient care, transforming operational efficiency and enhancing the quality of services provided.

Navigating the Insurance Verification Landscape

In the dynamic world of dental practices, insurance verification serves as the cornerstone for driving operational efficiency and ensuring financial stability. The insurance verification process, when streamlined, can minimize administrative burdens, allowing dental teams to prioritize patient care and improve the overall patient experience. Timeliness and accuracy in insurance verifications are essential, as they not only forestall claim denials or rejections but also cut down on bureaucratic glitches and potential financial setbacks. By embracing technological advancements like automated software and real-time verification tools, dental offices can significantly reduce human error, stay ahead in reimbursement processes, and maintain seamless operations. With proper insurance verification practices in place, dental practices can enhance both patient satisfaction and their own financial health.

Decoding Insurance Jargon and Policies

The realm of dental insurance is laden with jargon and intricacies that vary widely from one insurance provider to another. Successfully navigating these requires dental practices to engage in detailed management of insurance plans. Understanding insurance policies is crucial, especially when these policies affect the accuracy and clarity of billing. Utilizing automated systems can greatly improve efficiency by centralizing policy and coverage information, thus preventing coverage discrepancies and ensuring that dental staff are well-informed. Alongside technological solutions, maintaining clear communication with patients about insurance policy changes is vital to circumvent confusion and reduce the likelihood of rejected claims. By establishing a solid verification process, dental practices ensure a seamless start to the billing chain, promoting timely reimbursements and optimal financial health.

Understanding Policy Variations and Complexities

Insurance policies in the dental sector are multifaceted and often involve intricate elements such as coverage limits, exclusions, and pre-authorization requirements. These complexities require diligent attention to ensure that each patient's plan is thoroughly understood and correctly navigated. Automated insurance verification systems are invaluable in managing these complexities, as they seamlessly consolidate policy data, flag discrepancies, and update coverage changes efficiently. Understanding the nuances in policy variations across different insurers enables dental practices to preemptively tackle potential verification challenges. Regular updates on policy changes and a continuous dialogue with insurance companies can help dental offices provide accurate coverage details to patients. By mastering these complexities, dental practices can minimize administrative tasks, prevent payment delays, and improve the patient experience by avoiding unexpected billing surprises and out-of-pocket expenses.

Leveraging Technology for Streamlined Processes

As dental practices strive to enhance patient care and streamline their operations, integrating advanced technology becomes pivotal. Automated insurance verification software offers a strategic solution by significantly reducing manual administrative tasks, enhancing the precision of insurance details, and minimizing the risk of human error. Real-time verification tools have transformed how dental offices access and utilize insurance information, ensuring that patient billing and treatment plans are based on the most current data available. Additionally, electronic claims management systems further optimize financial processes by enabling instant claims filing and efficient follow-ups. The use of integrated practice management software not only facilitates seamless tracking and organization of patient information but also curtails redundant tasks, thereby improving the overall efficiency and financial health of the practice. By adopting these technologies, dental teams can ensure smooth operations, reduce claim denials, and ultimately refine the patient experience by cutting down on administrative delays and out-of-pocket expenses.

Integrating with Practice Management Systems

Automating insurance verification systems offer a transformative impact when seamlessly integrated with practice management systems in dental offices. These integrated systems automate many processes, pulling patient information directly from management databases and cross-referencing this data against comprehensive insurance databases in real-time. This automation drastically reduces manual data entry errors, allowing staff to focus on more patient-centric tasks instead of navigating through multiple platforms.

The integration allows for real-time access to patients’ insurance coverage details, meaning that dental teams no longer need to waste valuable time and effort on verifying coverage manually. Consequently, this results in a more efficient workflow that reduces the likelihood of costly billing surprises and payment delays, improving both the financial health of the practice and patient satisfaction.

By minimizing errors and alleviating manual tasks, integrating verification systems with practice management software optimizes the overall workflow in dental practices. The practice can allocate resources more effectively, reducing administrative burdens and enhancing patient care by focusing on individual needs and treatment plans.

Real-Time Verification Benefits

Real-time insurance verification tools provide dental practices with an essential capability: instant confirmation of a patient's insurance coverage before any treatment commences. This level of immediacy eliminates the traditional wait associated with securing confirmation from insurance providers, effectively reducing uncertainty for both the practice and the patient.

Implementing real-time verification enhances the accuracy of billing procedures and treatment plans by providing immediate access to correct and updated insurance information. This ensures that treatment plans are based on verified insurance details, preventing potential payment delays and claim denials. Moreover, the automation of real-time verification processes significantly cuts down on redundant administrative tasks, freeing up staff to focus more on patient care and less on paperwork.

Utilizing real-time verification tools directly contributes to improved patient satisfaction by minimizing treatment delays and uncertainties. Patients are more likely to appreciate the seamless experience and transparency in billing, recognizing the practice's efficiency in handling insurance-related concerns. By prioritizing accuracy and speed, dental offices can demonstrate their commitment to quality patient experiences and smooth administrative operations.

Reducing Claim Denials and Improving Collections

In the dynamic world of dental practice management, efficient insurance verification can make a substantial difference in reducing claim denials and enhancing the timeliness of collections. Automated dental insurance verification serves as a critical tool in this process, providing real-time, accurate insights into patient insurance coverage before dental procedures commence. By automating these processes, dental offices can preemptively tackle one of the primary causes of claim denials: insurance eligibility data issues. Statistics show that 85% of claim denials can be avoided through effective use of automation. Early verification of insurance details during claims submission expedites processing times, reduces payment delays, and ensures a smoother patient experience by preventing billing surprises. Ultimately, automation not only preserves valuable time but also significantly boosts the practice's financial health by stabilizing cash flow and diminishing the frequency of claim rejections.

Common Reasons for Claim Denials

Claim denials in dental practices can have a detrimental impact on revenue flow and operational efficiency. These denials are often attributed to unverified or incorrect insurance details. When information is missing or coded incorrectly during claims submission, the likelihood of denials surges. Moreover, if there is a change or expiration in a patient's insurance coverage that goes unnoticed before treatment, this can lead to denied claims. Another common issue arises from billing for dental procedures that aren't covered by the patient's insurance plan. Additionally, human error in recording patient details can echo through the verification process, culminating in rejected claims. Addressing these common pitfalls through diligent verification and process automation is paramount to maintaining smooth workflow and financial stability in dental offices.

Strategies to Enhance Insurance Collections

Enhancing insurance collections requires adopting strategies that integrate advanced technology and efficient processes within dental practices. Implementing cutting-edge dental software for insurance verification is a pivotal step towards reducing claim denials and curbing payment delays. Practices can choose between DIY (Do It Yourself) or DFY (Done For You) methods to streamline financial processes and bolster operational efficiency. By outsourcing insurance verification processes, dental teams can achieve higher accuracy and timely results without the burden of internal management. Moreover, integrating electronic systems dedicated to claim filing along with verification software allows for a seamless, synchronized approach to both insurance verification and financial management. This integration supports accurate billing and improved patient satisfaction by ensuring precise patient estimates and preventing payment delays. By focusing on these strategies, dental practices can not only improve their financial health but also provide enhanced patient care and experience.

Assessing Your Current Verification System

A consistent and robust insurance verification system is the backbone of any thriving dental practice, ensuring that claim rejections are minimized and revenue flows steadily. Streamlining this process goes beyond just administrative efficiency; it enhances the overall patient experience by reducing wait times and ensuring clarity in billing. Leveraging technology, such as automated software and real-time verification tools, can significantly reduce the burden of administrative tasks and minimize errors. A comprehensive verification system should start by checking patient coverage details before any treatment begins. This proactive approach not only prevents financial discrepancies but also reduces delays in billing and payments, ultimately securing accurate billing outcomes and maintaining the financial health of the practice.

Identifying System Weaknesses

Identifying weaknesses within a dental practice's insurance verification system is crucial for enhancing efficiency and accuracy. Often, specific areas, such as manual processes, are time-consuming and prone to errors, making them a primary source of bottlenecks. These inefficiencies can lead to appointment delays and billing issues, highlighting the need for a streamlined system. By closely examining these processes, dental practices can pinpoint where automation may have the most significant impact, improving the insurance verification process. Furthermore, understanding these weaknesses allows practices to evaluate the effectiveness of their current communication with insurance providers, ensuring that crucial information is exchanged promptly. Addressing these areas is vital to reducing the risk of human errors during data entry, ultimately contributing to a more accurate and efficient patient experience.

Measuring Efficiency and Productivity

Measuring the efficiency and productivity of your insurance verification process is critical to maintaining smooth operations in your dental practice. Implementing automated insurance verification solutions tailored specifically for dental offices can significantly enhance operational efficiency. These systems help reduce manual data entry, eliminating long hold times with insurance companies and minimizing the risk of claim denials. By integrating technology, such as automated software and real-time verification tools, dental practices can drastically improve their verification process, reducing the burden of administrative tasks. This technological advancement liberates valuable time for the dental team, allowing them to concentrate on more critical tasks, such as direct patient care. Moreover, efficient insurance verification underscores the importance of accurate billing and prevents potential billing surprises, enhancing the overall patient experience and ensuring a steady revenue stream.

Steps to Seamless Integration

Efficiently integrating insurance verification into a dental practice is vital for maintaining smooth operations and ensuring financial stability. By streamlining the insurance verification process, dental offices can save valuable time and enhance the overall experience for their patients. Incorporating technological solutions, such as automated software and real-time verification tools, significantly reduces administrative tasks, allowing dental teams to focus more on patient care. This integration not only prevents claim denials and billing surprises but also sets clearer financial expectations for patients. Ultimately, this leads to improved practice management and a more effective workflow.

Planning and Implementation

Successful planning and implementation of a streamlined insurance verification process are key to improving practice operations. By adopting automated software and real-time verification tools, dental practices can minimize administrative tasks and reduce the risk of claim rejections. A well-structured plan ensures that insurance information is verified before the commencement of dental procedures, providing accurate patient coverage analysis and eliminating payment delays. This proactive approach enhances financial health by ensuring consistent cash flow and accurate billing, while also improving patient satisfaction by offering transparency in out-of-pocket expenses.

Thorough planning allows dental practices to align their workflows with new technology, integrating seamlessly into existing systems. By doing so, they can avoid pitfalls associated with human error and claim denials. Clear communication with insurance providers ensures accurate insurance benefits are determined ahead of time, thereby protecting the practice’s revenue streams. This thoughtful implementation process ensures smooth operations, allowing dental practices to focus on delivering excellent patient care.

Training Staff for New Systems

Properly training staff to use new systems like automated insurance verification software is crucial for minimizing administrative tasks and reducing errors. Employing advanced technology enables dental practices to expedite insurance verification processes, setting clearer financial expectations for patients. Training staff in real-time verification tools enhances the overall patient experience by providing accurate and timely information about insurance policies, patient insurances, and eligibility.

Educating employees about these new systems can significantly diminish claim denials and prevent payment delays, thereby boosting operational efficiency. Well-trained staff can effectively manage the insurance verification process, ensuring smooth, accurate billing practices. This, in turn, enhances financial health by maintaining a steady cash flow, while freeing up valuable time for dental teams to provide focused and exceptional patient care. Ultimately, the success of integrating new technology lies in the proper training of the personnel tasked with its operation.

Overcoming Common Challenges

Streamlining insurance verification in a dental practice can significantly enhance both operational efficiency and financial health. A smooth insurance verification process is vital, as it helps prevent claim denials and avoids unnecessary out-of-pocket expenses for patients. By integrating automated technology, dental offices can reduce human error and the time spent on administrative tasks. Automated systems for real-time verification can ensure that dental teams accurately bill patients by confirming insurance benefits, which in turn fosters a positive patient experience. Dental practices must consider whether to manage this process internally or outsource it, each option providing unique benefits. The key is to leverage technology effectively to stay ahead of administrative challenges and maintain smooth operations that prioritize patient care.

Updating Outdated Patient Information

Keeping patient information up-to-date is a formidable task but essential to a streamlined insurance verification process. Utilizing online patient forms can greatly simplify updating patient details, including changes in address and insurance providers. This ensures the practice maintains accurate insurance data, which is crucial since incomplete or inaccurate information can lead to as much as 25% of claim rejections. Regular verification before each appointment helps anticipate and rectify any discrepancies, minimizing billing surprises and improving financial expectations. Integrating systems that facilitate real-time updates further enhances accuracy. Neglecting to update patient information can disrupt workflow, leading to increased verification errors and claim denials, which could negatively impact the practice's financial health.

Managing Complex Insurance Policies

Navigating through the complexities of varied insurance policies is another challenge dental practices face. These policies often come with different coverage limits, exclusions, and pre-authorization requirements, necessitating close communication with insurance carriers. The differences between providers demand dental practices meticulously track and manage requirements for each patient, ensuring accuracy in treatment planning and cost forecasting. By utilizing automated systems to centralize policy information, dental practices can easily monitor discrepancies in patient coverage, preventing unexpected costs and facilitating smooth financial operations.

Outsourcing insurance verification and billing services is an option that offers considerable benefits by entrusting these tasks to trained professionals who are adept at managing complex policies. This approach reduces errors and streamlines administrative processes, allowing dental teams to focus more on patient care and enhancing the overall patient experience. With the help of technology and professional services, dental practices can efficiently handle these complexities and maintain steady cash flow, mitigating risks associated with claim denials and rejections.

Best Practices for Insurance Verification Optimization

Streamlining the insurance verification process in dental practices is crucial for enhancing patient care while maintaining operational efficiency. Implementing automated systems that integrate seamlessly with practice management software can significantly reduce the tediousness of manual data entry, the risk of human error, and unexpected billing surprises. By leveraging technology, dental teams can handle insurance verifications more accurately and promptly, ensuring that patient insurances and benefits are confirmed before dental procedures commence. This not only minimizes claim denials and rejections but also optimizes the financial health of the practice by promoting a steady revenue cycle. Additionally, practices can consider outsourcing verification tasks through services like Done-For-You (DFY) options, allowing staff to focus on patient care instead of administrative burdens. Ultimately, evaluating whether a practice is better suited for a DIY or DFY insurance verification approach hinges on understanding its unique needs and resources.

Electronic Claims Management

Electronic claims management is a pivotal component in optimizing insurance verification for dental practices. By moving away from paperwork and embracing automated claims systems, dental offices can ensure a more efficient and error-free claims submission process. These systems integrate with practice management software, providing a seamless flow of real-time insurance information. This integration not only reduces administrative tasks but also ensures higher accuracy in billing.

Moreover, electronic claims management is instrumental in minimizing payment delays and claim denials. By ensuring all necessary documentation is complete and accurate before submission, dental practices can maintain a steady revenue flow. The real-time verification feature enables instant access to up-to-date insurance details, which enhances billing accuracy and significantly reduces the occurrence of claim rejections. Integrating this technology into daily operations helps streamline tasks, allowing dental teams to focus more on patient care rather than being bogged down by the complexities of insurance claims.

Establishing Verification Protocols

Establishing robust insurance verification protocols is essential for the smooth operation of dental practices. These protocols ensure that patient insurance coverages are accurately analyzed before any treatment, preventing claim denials and maximizing potential revenue streams. Comprehensive verification procedures are central to maintaining operational stability and financial health within a practice. They assist in creating streamlined processes that reduce administrative burdens and enhance the overall patient experience.

Incorporating real-time verification tools into these protocols can drastically reduce errors and administrative workload, ensuring clear and accurate billing. This step can promote steady cash flow by eliminating delays and ensuring insurance confirmations are completed efficiently. By verifying dental insurance eligibility prior to initiating treatment, practices not only protect their financial interests but also reduce administrative distractions. Effective verification protocols therefore play a crucial role in saving valuable time and increasing productivity, ultimately supporting the practice’s operational and financial objectives.

Tailored Solutions for Practices and Patients

In today’s competitive dental landscape, practices must balance efficient operations with exceptional patient care. A significant aspect of this balance is how they handle insurance verification, a task that can be both time-consuming and prone to errors if not managed properly. By tailoring their insurance verification methods, dental practices can optimize their internal workflow processes and improve financial health. The choice between a Do-It-Yourself (DIY) approach and a Done-For-You (DFY) service such as those offered by EZ Dental Billing empowers practices to determine how much control or efficiency they prefer. This flexibility enables practices to streamline operations, reducing administrative tasks while ensuring accurate insurance benefits are communicated to patients, thereby enhancing the overall patient experience. Practices can avoid billing surprises and claim denials, maintaining smooth operations and uninterrupted patient care.

Customizing Verification Processes

Customization in insurance verification can revolutionize the way dental practices operate. With the incorporation of advanced technologies like those from Flex Dental Solutions, practices can automate and tailor their verification systems to fit their specific needs. This technological advancement allows dental offices to reclaim valuable time, letting dental teams focus more on patient care rather than insurance logistics. Moreover, by implementing automated systems, practices can drastically reduce human error, claim rejections, and payment delays, which consequently improves patient satisfaction.

Automated verification processes are instrumental in reducing administrative workload. By minimizing the manual aspects of insurance verification, practices can avoid common errors that lead to billing surprises or claims denials. This precision not only streamlines revenue flow but also ensures financial health by maintaining accurate billing. Incorporating customizable systems enhances operational efficiency, allowing dental practices to serve patients better and improve their competitive edge.

The ability to tailor verification processes based on specific operational needs is a strategic advantage for dental practices. By choosing systems that allow adjustment according to internal resources and patient demand, practices can achieve smooth operations. Furthermore, these systems enable better management of insurance coverage details, providing clarity to patients and reducing out-of-pocket expenses. Ultimately, a customizable verification process supports a premium patient experience by allowing practices to deliver more reliable and prompt services.